Dynamic Asset-Liability Management

- Details

- Category: Poles of competences

Insurance asset liability management (ALM) is the process of studying an insurance company’s exposure to asset and liability risk, defining its risk tolerance and its financial goals and planning the actions it should take in order to limit its exposure while reaching those goals.

Insurance ALM risk is the risk incurred when asset and liabilities terms are mismatched, forcing the company to buy and sell assets, or to take on liabilities, when conditions are unfavorable.

The most common ALM risks are two types of interest risk:

- The first, reinvestment risk, refers to the uncertainty regarding investment returns that will be available upon the reinvestment of excess cash flow related to proceeds from investments. If interest rates have decreased, then the excess cash flow will have to be reinvested at rates below those on the existing or maturing assets.

- The second, disinvestment risk, arises when fixed-income assets must be sold prior to maturity to meet cash flow needs, typically because the net cash flow is negative without the sale of these assets. If interest rates have increased, then the market value of these assets has decreased and they will be sold at a relative loss

Life insurers are particularly exposed to asset and liability mismatching given the long-term nature of their engagements. To better assess and manage risks, insurers look at asset and liability duration. Scenario testing and dynamic financial analysis are two techniques used in insurance ALM.

Modeling systems characterized by multiple sub-models

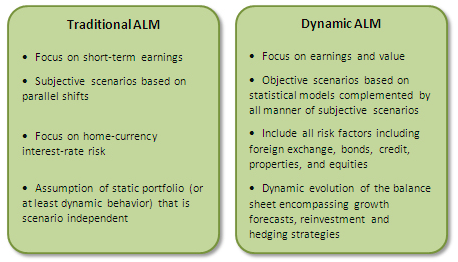

In recent years, many insurers have done significant work on their asset-liability management. Many life insurers have very sophisticated models of their assets and liabilities, although often the focus of these has not been on operational ALM and the use of models to improve the investment strategy of the companies, but rather on longer-term projections for MCEV or economic capital.

Regulatory change towards Solvency II and a fair value/realistic approach also leads to greater transparency as regards risk management and the stability of the economic balance sheet.

In these contexts, we can offer a much more comprehensive ALM solution through the use of Dynamic Asset-Liability Management.

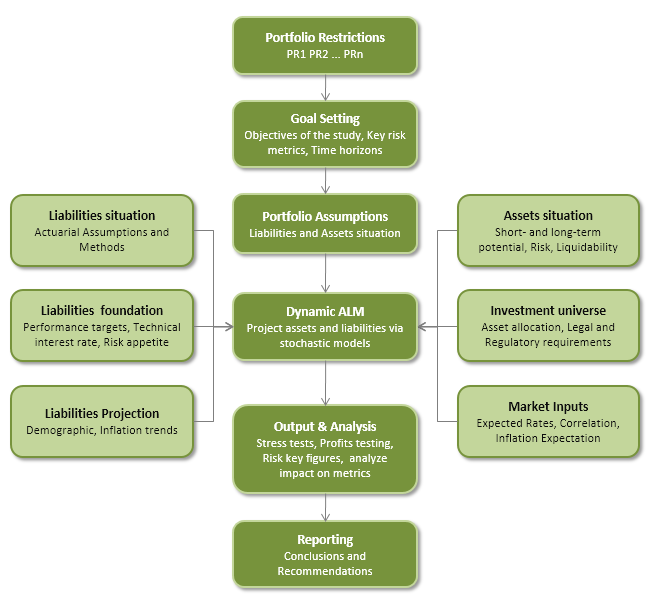

However, the introduction of a Dynamic ALM model requires actuarial expertise coupled with a sophisticated analytic engine that can execute the vast number of required stochastic projection runs and manage the data inputs and results output within an automated end-to-end process with limited manual interaction.

Through the stochastic simulation processes, we can quantify the risk of asset / liability mismatch, and then we can help our clients to construct strategies to reduce their risks and thereby reduce their capital requirements under Solvency II.

Our solution: advanced risk simulation techniques with in depth actuarial knowledge

At Brainmize, we combine our advanced risk simulation techniques with our in depth actuarial knowledge to help our clients to perform ALM so they can better manage their risks - whatever they may be.

We aim to show how sophisticated financial models can be used more directly to optimize investment strategy.

- Development of ALM models including management actions, customer behaviours, accounting rules

- Pricing of financial products and derivatives

- Implementation and calibration of stochastic processes under real world or risk neutral measure or both: interest rate, inflation, spread/credit, currency, shares, real estate, mortgages, derivatives

- Conception of robust ALM indicators used in evolved financial reporting

Our Advantage: Reduce your risks and thereby reduce your capital requirements under Solvency II

We help our clients to formulate financial models and assumptions, run stochastic simulations and produce results that are easy to understand for management.

What's more, we leave behind our models and train your staff to do it yourselves, if necessary.

- Identify risks and risk drivers

- Help define enterprise risk tolerance and individual risk volatility parameters

- Build a financial model for integrated asset/liability testing

- Provide a scenario generator for randomized stochastic modeling

- Generate financial statements, capital ratios and other financial risk metrics

Using this advanced model, our clients can answer questions such as:

- What is the optimal investment and interest rate policy?

- How can we refine the strategic asset mix and construct an actual asset portfolio?

- What is the impact of various reporting systems on the balance sheet and profit and loss account?

- What kind of influence does the size and nature of new production have on the existing policy?

- What are the consequences of the Solvency II guidelines?